Welcome back to the Northern Liberties Apartments case study! If you’ve been following along, Part 1 covered a detailed overview of my first multifamily real estate investment. We explored the project overview, performance highlights, and investment timeline, while also showcasing the property’s transformation with before-and-after photos. If you missed Part 1, click here to catch up.

In Part 2, we’ll double-click on the strategic steps that led to the successful acquisition of the property. We’ll dive into the market selection process, deal identification, the initial financial projections, and the due diligence phase. Finally, we’ll break down how we structured the capital stack and navigated the final steps to complete the acquisition.

By examining this deal in greater detail, I hope to provide you with insights into the KWM Capital Way from acquisition to renovation to stabilization. If you’d like to learn more about how you can partner with KWM Capital or explore similar investment opportunities, schedule a call with me here. Know someone who might benefit from these insights? Forward this to them or encourage them to subscribe to our newsletter for future updates.

Ready for round 2? Lets go!

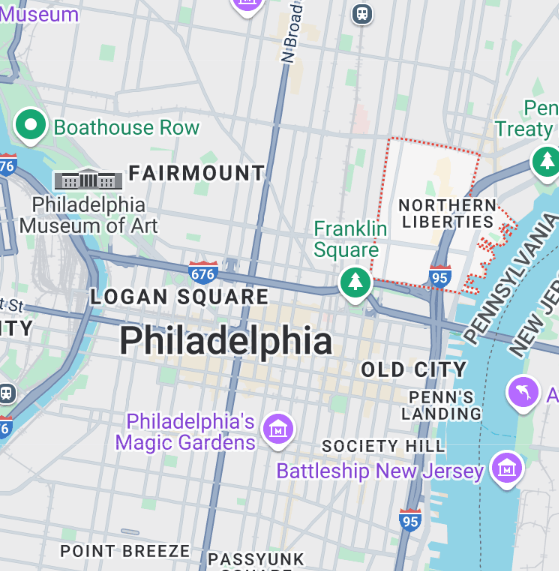

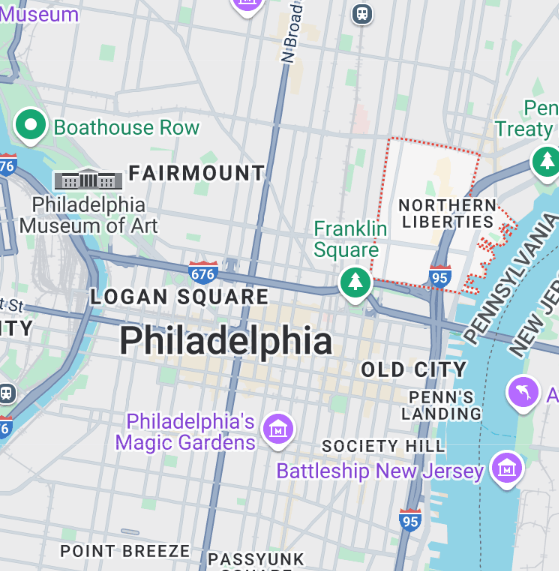

The property was located in one of my target neighborhoods, Northern Liberties, situated just north of Center City. The area was undergoing a wave of revitalization, bringing in new businesses, restaurants, and residential developments. The momentum in the area was driven by it’s excellent location within the city. It offered convenient access to public transportation, major highways like I-95 and the Pennsylvania Turnpike, and downtown Philadelphia. Local attractions, including the restaurants and bars on 2nd Street and the new development of the “Piazza,” added to its appeal, making it highly desirable for renters. The growing demand for housing in the neighborhood provided a strong foundation for long-term value appreciation.

The property was located in one of my target neighborhoods, Northern Liberties, situated just north of Center City. The area was undergoing a wave of revitalization, bringing in new businesses, restaurants, and residential developments. The momentum in the area was driven by it’s excellent location within the city. It offered convenient access to public transportation, major highways like I-95 and the Pennsylvania Turnpike, and downtown Philadelphia. Local attractions, including the restaurants and bars on 2nd Street and the new development of the “Piazza,” added to its appeal, making it highly desirable for renters. The growing demand for housing in the neighborhood provided a strong foundation for long-term value appreciation.

Equally compelling was the condition of the property. Unlike many older buildings in the area, this triplex had been well-maintained by its previous owner. With minimal deferred maintenance required, we could focus on targeted upgrades that would unlock the property’s potential without the need for an extensive and costly overhaul. This allowed for a faster path to increasing net operating income and enhancing the overall value of the property.

The most exciting aspect of the deal was the financial upside. All three units were significantly under market rent, and the vacant third-floor unit presented an immediate opportunity to generate additional income. The asking price was also below market value, creating built-in equity from the acquisition. The combination of immediate positive cash flow and the ability to reposition the property through strategic improvements made it a home run.

Recognizing its potential, I moved quickly. Within hours of its listing, I toured the property and submitted an offer at the asking price of $670,000. The offer was accepted the same day, marking a pivotal moment in my real estate journey. The days that followed confirmed the strength of the deal. Competing bids came in well above the asking price after ours was accepted, validating the built-in equity and strong fundamentals of the property. It was clear that this deal had all the right elements for success, but we were just getting started!

Equally compelling was the condition of the property. Unlike many older buildings in the area, this triplex had been well-maintained by its previous owner. With minimal deferred maintenance required, we could focus on targeted upgrades that would unlock the property’s potential without the need for an extensive and costly overhaul. This allowed for a faster path to increasing net operating income and enhancing the overall value of the property.

The most exciting aspect of the deal was the financial upside. All three units were significantly under market rent, and the vacant third-floor unit presented an immediate opportunity to generate additional income. The asking price was also below market value, creating built-in equity from the acquisition. The combination of immediate positive cash flow and the ability to reposition the property through strategic improvements made it a home run.

Recognizing its potential, I moved quickly. Within hours of its listing, I toured the property and submitted an offer at the asking price of $670,000. The offer was accepted the same day, marking a pivotal moment in my real estate journey. The days that followed confirmed the strength of the deal. Competing bids came in well above the asking price after ours was accepted, validating the built-in equity and strong fundamentals of the property. It was clear that this deal had all the right elements for success, but we were just getting started!

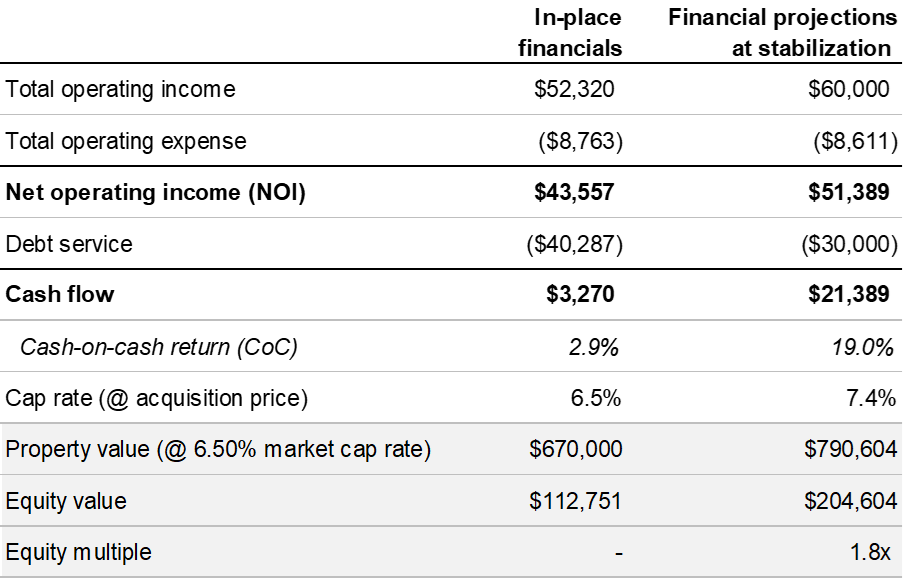

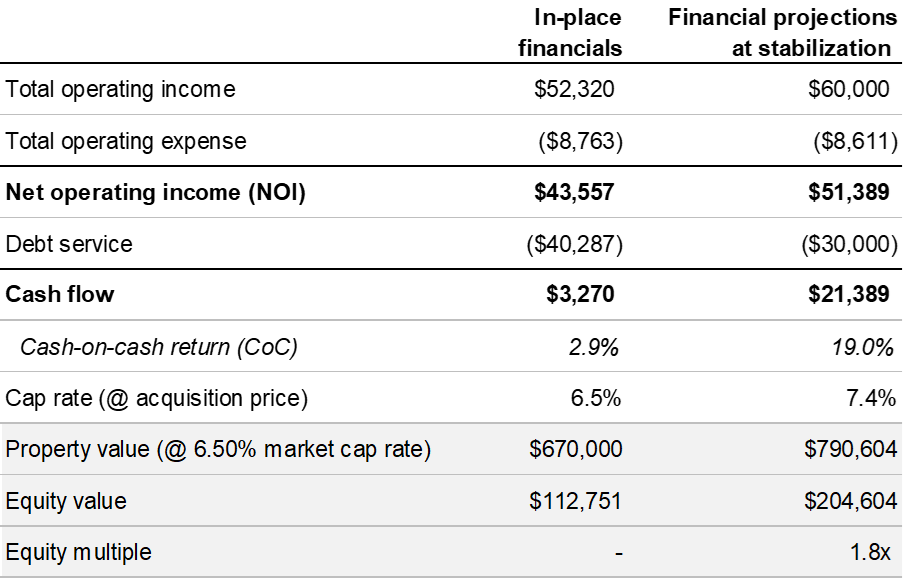

At acquisition, cash flow was moderate, with initial rents totaling $4,360 per month (or $52,320 annually) across the three units. This resulted in a monthly cash flow of $3,270 after accounting for operating expenses and debt service, yielding a 2.9% cash-on-cash return and a 6.50% going-in cap rate based off the purchase price.

Our business plan projected stabilization by the end of 2021 with rents achieving targeted market-rate rent adjustments for each unit. We conservatively anticipated raising rents to $1,600 per month on the first and second floors, and $1,800 on the vacant third floor, pushing total annual operating income to $60,000. With net operating income increasing to $51,389, the property would achieve a 7.4% cap rate at stabilization. Annual cash flow would be boosted to $21,389, raising the cash-on-cash return to 19.0%. In year 3 of our projection model (2021), we estimated a refinance to repay the bridge loan and support further property improvements. Given the solid cash-on-cash returns and our goal to hold this asset indefinitely, we did not assume a future sale of the property. We viewed Northern Liberties Apartments as a long-term investment that will continue to generate steady income and appreciation, making it a valuable asset to retain in our portfolio.

At acquisition, cash flow was moderate, with initial rents totaling $4,360 per month (or $52,320 annually) across the three units. This resulted in a monthly cash flow of $3,270 after accounting for operating expenses and debt service, yielding a 2.9% cash-on-cash return and a 6.50% going-in cap rate based off the purchase price.

Our business plan projected stabilization by the end of 2021 with rents achieving targeted market-rate rent adjustments for each unit. We conservatively anticipated raising rents to $1,600 per month on the first and second floors, and $1,800 on the vacant third floor, pushing total annual operating income to $60,000. With net operating income increasing to $51,389, the property would achieve a 7.4% cap rate at stabilization. Annual cash flow would be boosted to $21,389, raising the cash-on-cash return to 19.0%. In year 3 of our projection model (2021), we estimated a refinance to repay the bridge loan and support further property improvements. Given the solid cash-on-cash returns and our goal to hold this asset indefinitely, we did not assume a future sale of the property. We viewed Northern Liberties Apartments as a long-term investment that will continue to generate steady income and appreciation, making it a valuable asset to retain in our portfolio.

Northern Liberties Apartments: Market selection to acquisition closing

Market selection and deal identification

Even before 2019, Philadelphia had long been on my radar as an excellent location for my first multifamily real estate investment. The city offered the perfect mix of relative affordability, strong rental demand, market growth, and accessibility to my lifestyle at the time, making it an ideal place to implement my dual-purpose strategy of house hacking. Living in one unit while renting out the others would not only reduce my living expenses but also provide invaluable, hands-on experience in managing the asset—a critical element for my first investment, where I could directly address and learn from every challenge that came my way. Philadelphia’s rental demand was steadily increasing, driven by a growing population, an influx of young professionals, and a strong job market. Among its many vibrant neighborhoods, I specifically targeted a few up-and-coming areas that showed strong growth potential, including Northern Liberties. With six months of tireless effort and local immersion, I spent many weekends in the neighborhoods I was targeting, often accompanied by my real estate mentors, observing the subtle details that made each area unique. I hung out in local coffee shops, visited restaurants and bars, and walked through multifamily properties on the market. Immersing myself in the market allowed me to better understand the demographics and dynamics of each neighborhood, which sharpened my underwriting skills. I began noticing factors that would add or subtract value from each potential deal—whether it was proximity to public transportation, neighborhood amenities, or the types of tenants the area attracted. These insights became invaluable when evaluating properties. During this time, I slept on friends’ couches to maximize my time in the area (while also enjoying the local nightlife!) and focused all my weekend time on finding an investment opportunity. I analyzed dozens of deals and even had an offer accepted on another property, only for the deal to fall apart during inspection. Despite the setbacks, the experience taught me valuable lessons in deal hunting and prepared me for when the right opportunity came along. After months of searching, Northern Liberties Apartments emerged as a standout opportunity. I discovered it through a Zillow auto alert I had set up, and it immediately caught my attention. Its unoccupied third-floor unit made it a perfect house-hacking candidate, while the other units offered significant potential for growth through strategic renovations and rental increases. The property was located in one of my target neighborhoods, Northern Liberties, situated just north of Center City. The area was undergoing a wave of revitalization, bringing in new businesses, restaurants, and residential developments. The momentum in the area was driven by it’s excellent location within the city. It offered convenient access to public transportation, major highways like I-95 and the Pennsylvania Turnpike, and downtown Philadelphia. Local attractions, including the restaurants and bars on 2nd Street and the new development of the “Piazza,” added to its appeal, making it highly desirable for renters. The growing demand for housing in the neighborhood provided a strong foundation for long-term value appreciation.

The property was located in one of my target neighborhoods, Northern Liberties, situated just north of Center City. The area was undergoing a wave of revitalization, bringing in new businesses, restaurants, and residential developments. The momentum in the area was driven by it’s excellent location within the city. It offered convenient access to public transportation, major highways like I-95 and the Pennsylvania Turnpike, and downtown Philadelphia. Local attractions, including the restaurants and bars on 2nd Street and the new development of the “Piazza,” added to its appeal, making it highly desirable for renters. The growing demand for housing in the neighborhood provided a strong foundation for long-term value appreciation.

Equally compelling was the condition of the property. Unlike many older buildings in the area, this triplex had been well-maintained by its previous owner. With minimal deferred maintenance required, we could focus on targeted upgrades that would unlock the property’s potential without the need for an extensive and costly overhaul. This allowed for a faster path to increasing net operating income and enhancing the overall value of the property.

The most exciting aspect of the deal was the financial upside. All three units were significantly under market rent, and the vacant third-floor unit presented an immediate opportunity to generate additional income. The asking price was also below market value, creating built-in equity from the acquisition. The combination of immediate positive cash flow and the ability to reposition the property through strategic improvements made it a home run.

Recognizing its potential, I moved quickly. Within hours of its listing, I toured the property and submitted an offer at the asking price of $670,000. The offer was accepted the same day, marking a pivotal moment in my real estate journey. The days that followed confirmed the strength of the deal. Competing bids came in well above the asking price after ours was accepted, validating the built-in equity and strong fundamentals of the property. It was clear that this deal had all the right elements for success, but we were just getting started!

Equally compelling was the condition of the property. Unlike many older buildings in the area, this triplex had been well-maintained by its previous owner. With minimal deferred maintenance required, we could focus on targeted upgrades that would unlock the property’s potential without the need for an extensive and costly overhaul. This allowed for a faster path to increasing net operating income and enhancing the overall value of the property.

The most exciting aspect of the deal was the financial upside. All three units were significantly under market rent, and the vacant third-floor unit presented an immediate opportunity to generate additional income. The asking price was also below market value, creating built-in equity from the acquisition. The combination of immediate positive cash flow and the ability to reposition the property through strategic improvements made it a home run.

Recognizing its potential, I moved quickly. Within hours of its listing, I toured the property and submitted an offer at the asking price of $670,000. The offer was accepted the same day, marking a pivotal moment in my real estate journey. The days that followed confirmed the strength of the deal. Competing bids came in well above the asking price after ours was accepted, validating the built-in equity and strong fundamentals of the property. It was clear that this deal had all the right elements for success, but we were just getting started!

Initial financial projections

Below is a summary of the initial financial projections that were finalized during the due diligence phase once the deal was under contract. At acquisition, cash flow was moderate, with initial rents totaling $4,360 per month (or $52,320 annually) across the three units. This resulted in a monthly cash flow of $3,270 after accounting for operating expenses and debt service, yielding a 2.9% cash-on-cash return and a 6.50% going-in cap rate based off the purchase price.

Our business plan projected stabilization by the end of 2021 with rents achieving targeted market-rate rent adjustments for each unit. We conservatively anticipated raising rents to $1,600 per month on the first and second floors, and $1,800 on the vacant third floor, pushing total annual operating income to $60,000. With net operating income increasing to $51,389, the property would achieve a 7.4% cap rate at stabilization. Annual cash flow would be boosted to $21,389, raising the cash-on-cash return to 19.0%. In year 3 of our projection model (2021), we estimated a refinance to repay the bridge loan and support further property improvements. Given the solid cash-on-cash returns and our goal to hold this asset indefinitely, we did not assume a future sale of the property. We viewed Northern Liberties Apartments as a long-term investment that will continue to generate steady income and appreciation, making it a valuable asset to retain in our portfolio.

At acquisition, cash flow was moderate, with initial rents totaling $4,360 per month (or $52,320 annually) across the three units. This resulted in a monthly cash flow of $3,270 after accounting for operating expenses and debt service, yielding a 2.9% cash-on-cash return and a 6.50% going-in cap rate based off the purchase price.

Our business plan projected stabilization by the end of 2021 with rents achieving targeted market-rate rent adjustments for each unit. We conservatively anticipated raising rents to $1,600 per month on the first and second floors, and $1,800 on the vacant third floor, pushing total annual operating income to $60,000. With net operating income increasing to $51,389, the property would achieve a 7.4% cap rate at stabilization. Annual cash flow would be boosted to $21,389, raising the cash-on-cash return to 19.0%. In year 3 of our projection model (2021), we estimated a refinance to repay the bridge loan and support further property improvements. Given the solid cash-on-cash returns and our goal to hold this asset indefinitely, we did not assume a future sale of the property. We viewed Northern Liberties Apartments as a long-term investment that will continue to generate steady income and appreciation, making it a valuable asset to retain in our portfolio.

Due diligence period

Upon signing the purchase and sale agreement at an acquisition price of $670,000, we immediately initiated a comprehensive due diligence process. We initially set a 60-day closing period, however, at the seller’s request, we negotiated to shorten the timeline to 45 days. This accelerated closing required us to move quickly, so we immediately initiated a comprehensive due diligence process. This included a thorough review of the property’s financials, a detailed physical inspection, title, zoning and environmental checks, and validation of the property’s overall condition. The goal in any due diligence period is to identify any potential risks early and confirm that the property continues to align with our initial investment thesis.Physical due diligence

Although there were a few small maintenance items flagged during the inspection, there were no major issues in the financial or physical inspections. These minor issues were addressed by negotiating a $1,000 credit from the seller at closing, a small win that still allowed us to preserve capital for the larger renovations planned. The only major issue was an angry dog and an even angrier tenant who was unaware of the physical apartment inspection that was set to take place!The capital stack

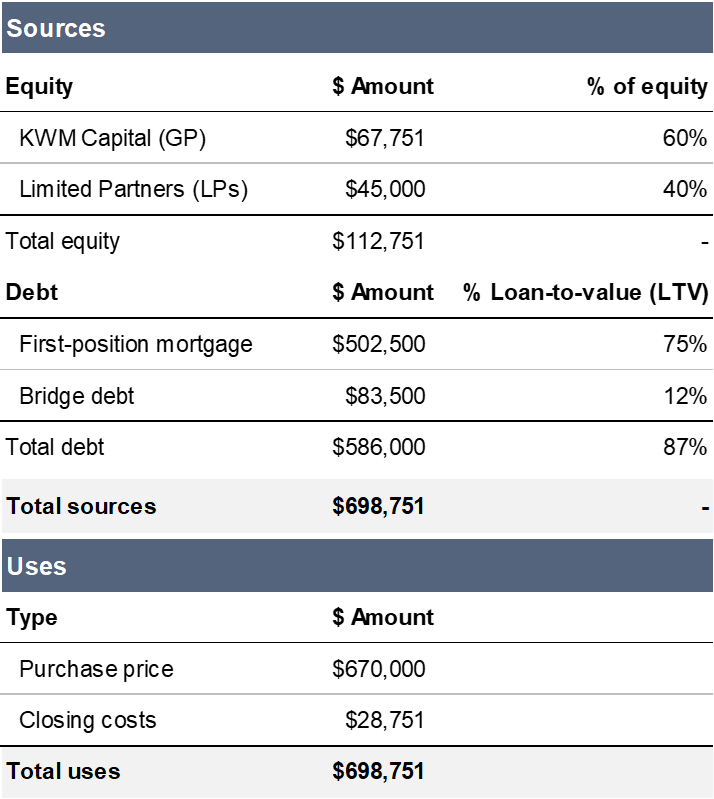

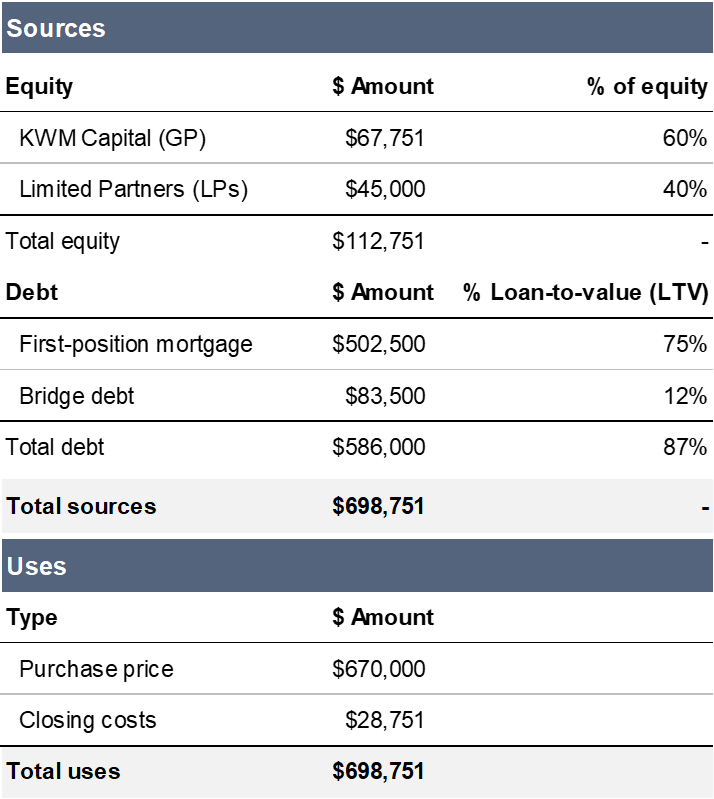

Concurrent with the due diligence workstreams, we moved quickly to secure both equity and debt financing. We reached out to limited partners to raise the necessary equity and engaged with lenders to structure the debt portion of the capital stack. Securing the equity portion of the capital stack was a critical step in closing this deal, and I was fortunate to receive the backing of my immediate family. After the purchase and sale agreement was signed, I presented the investment opportunity to them, explaining the potential of Northern Liberties Apartments and detailing the business plan. Seeing the opportunity, as well as believing in my vision and capability to execute the business plan, my parents and brother committed their support. With $67,751 of my own funds (60% of the equity), my family stepped in to help close the gap by contributing $45,000 (40% of the equity). Their decision to invest wasn’t just about the numbers—it was also a testament to the trust they place in me and my ability to execute the vision KWM Capital laid out. Having my family as initial investors was both a privilege and a responsibility, and very humbling and motivating; it reinforced the responsibility I felt to make this deal a success and honor the trust they placed in me. Debt financing for the acquisition was structured to maximize leverage to optimize returns. Initially, our underwriting targeted a 90% loan-to-value (LTV) based on early discussions with lenders, anticipating a very low down payment on the property. The original debt component we agreed on with the mortgage company, LoanDepot was a first-position mortgage of $603,000 with an interest rate of 4.38% interest and a 30-year amortization—favorable terms that would support our business plan. However, as we moved through the financing process, the lender revised their terms multiple times, eventually reducing the LTV needed to close to 75% (mortgage amount of $502,500) just five days before closing. This last-minute change nearly jeopardized the deal, requiring a larger equity contribution than originally planned and creating an immediate funding gap. Rather than abandon a home run deal, we decided to get creative with the financing to bridge the gap. We secured a $67,000 bridge loan from Republic Bank, structured as a 15-year loan with a 5.49% interest rate, which provided additional leverage without overextending the capital stack. Additionally, I arranged a $16,500 loan from my parents at a 3.65% interest rate over five years. This support from my family, both as equity and debt investors—will never be forgotten. With a total of $83,500 of bridge debt in place, we successfully brought the overall LTV back up to 87%, close to our original 90% target. This creative financing solution enabled us to close the deal on time and provided access to capital for planned renovations. Navigating these last-minute changes within a tight 45-day closing period was challenging and taught me invaluable lessons in flexibility and problem-solving. By leveraging both conventional financing and family support, we were able to finalize the acquisition and move forward with our value-add business plan, transforming a challenging financing situation into a foundation for future success.