Welcome back to Part 3 of the Northern Liberties Apartments case study! If you’ve been following along, I want to take a moment to sincerely thank you for your interest and support—it means a great deal to me. If you’re just joining us, no worries—you can catch up on Part 1 and Part 2 to get the full story and see how this journey unfolded. And if this case study inspires you or sparks questions about how we can partner on future investment opportunities, I’d love to hear from you—schedule a call with me here.

If you know someone who might find this valuable, feel free to share it with them or encourage them to subscribe to our newsletter. They’ll get updates on investment opportunities, real estate insights, and more inspiring case studies like this one.

Before we jump back in, let’s do a quick recap.

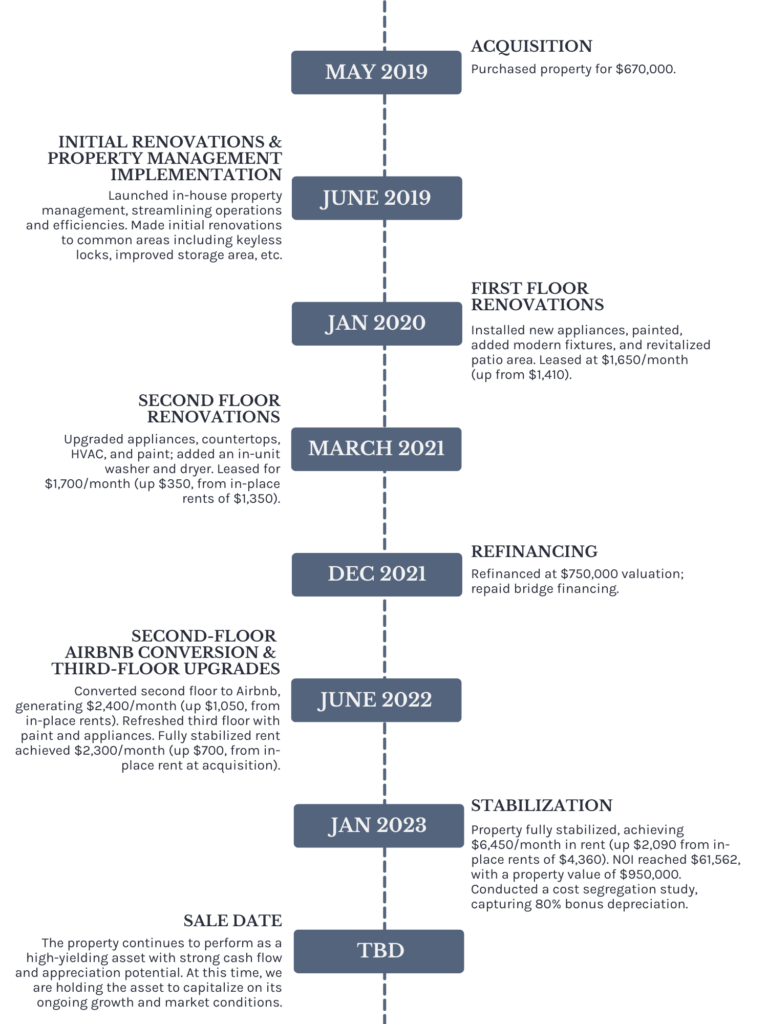

In Part 1, we explored how years of preparation and strategic planning led to the acquisition of my first multifamily real estate investment, Northern Liberties Apartments. We gave a brief summary of how we found the property, why we liked it (investment highlights), the business plan we crafted, how we financed the deal, the investment timeline, and a glimpse of the transformation through before-and-after photos.

Part 2 dove deeper into the strategic decisions that paved the way for a successful acquisition. It provided an in-depth look at the market selection process, deal identification, initial financial projections, and the creative financing strategies that made closing the deal possible.

In Part 3, we’ll dive into the renovation process, operational improvements, and value-add strategies that brought the property to full stabilization. We’ll highlight key upgrades to individual units and shared spaces while breaking down the numbers behind the financial transformation. You’ll see how executing our business plan boosted NOI and property value, exceeding our financial projections—ultimately tripling our initial investment and showcasing KWM Capital’s strategic approach to creating lasting value for investors and tenants alike. Finally, we’ll reflect on the lessons learned throughout this journey and share key takeaways that continue to shape our real estate investment strategy.

OK, it’s time for the final chapter of the case study—grab your hard hat, and let’s go!

Northern Liberties Apartments: Post-acquisition renovations to property stabilization

Introduction to the renovation & value-add process

Once the acquisition was finalized, KWM Capital immediately began executing the business plan with a clear objective: increasing rents and decreasing expenses to maximize NOI, ultimately driving forced property value appreciation.

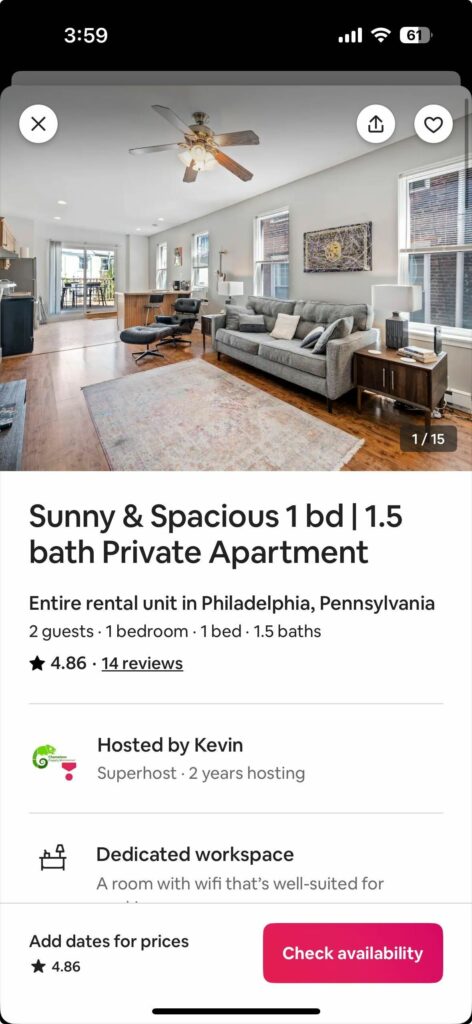

We prioritized high-impact upgrades to both individual units and common areas, creating a modern, attractive, and well-functioning property that appealed to tenants and stood out in the competitive Northern Liberties market. Every improvement was carefully selected to enhance the property’s income potential while maintaining cost efficiency. These renovations were further supported by operational efficiencies, including the introduction of in-house property management, which provided greater control over expenses and streamlined day-to-day operations.

Below is a step-by-step guide to the asset management efforts, detailing the value-add improvements made at each stage. But before diving in, let’s review the timeline from Part 1.

June 2019 – Initial renovations and property management implementation

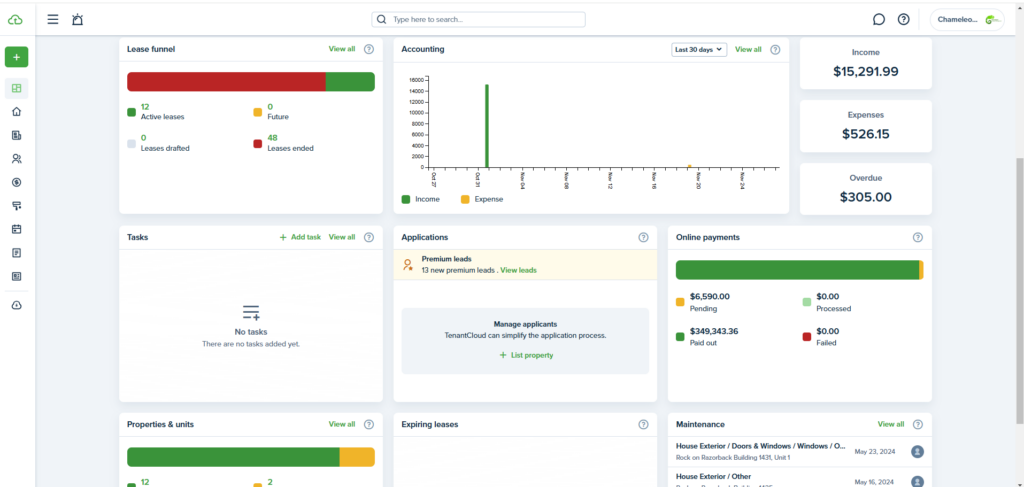

Immediately after closing in late May of 2019, we implemented our in-house property management team, Chameleon Property Management, to take a hands-on approach in managing the property. With Chameleon Property Management, we introduced TenantCloud, a robust property management software that streamlined processes and improved tenant relations. Implementing TenantCloud enhanced rent collection efficiency, allowed tenants to submit maintenance requests directly through the platform, and facilitated swift communication between tenants and management / KMW Capital—all of which contributed to a higher standard of service and smoother operations. This software also improved the leasing process by allowing us to deeply vet tenants, which reduced vacancy rates in the future.

Concurrently with the launch of Chameleon Property Management, we began upgrades to the common areas to enhance security, functionality, and the overall appeal of the property. One of the first improvements was the installation of keyless entry locks, adding an advanced level of access control for tenants and the property management team. These locks provided convenient and secure access, allowing us to set temporary guest codes for maintenance staff, monitor lock battery levels, and enhance the overall tenant experience. This sophisticated technology offered both convenience and peace of mind, adding significant value to tenants.

To further improve the aesthetics of the common areas, we added artwork depicting iconic Philadelphia scenes, adding a welcoming, local touch to the property. Additionally, we installed a large mirror in the second-floor hallway—a practical feature that tenants could use and enjoy, bringing an extra sense of style and personality to the space. These thoughtful enhancements contributed to a more inviting environment, creating a positive first impression for current and prospective tenants alike.

In addition to these interior common area upgrades, we also undertook a major cleanup of the basement, which had been cluttered with old, unused items. We cleaned and organized the space, creating dedicated storage areas where tenants could keep personal belongings such as bikes and seasonal items. This additional storage was a valuable amenity, providing tenants with much-needed extra space and enhancing the property’s overall appeal to prospective renters.

In terms of exterior upgrades, we repointed the brickwork on the side of the building to protect the property’s interior from potential water penetration, which can lead to structural damage and costly repairs if left unaddressed. By renewing the mortar between bricks, we improved the building’s durability and ensured long-term protection against the elements, adding both value and longevity to the structure. In the outdoor side alley trash area, we made organizational improvements to facilitate proper waste disposal, making it more efficient and accessible for all residents.

Lastly, and perhaps most importantly, during this period we leased the vacant third-floor unit at $1,800 per month. I personally moved into the unit with a roommate, achieving my goal of house hacking. This strategy not only maximized rental income but also allowed me to maintain an on-site presence, which supported both property management and fostered a stronger connection with the tenant community. Additionally, as existing leases turned over, we introduced pet rent as a new income stream—offering a pet-friendly option for tenants while further increasing the property’s revenue.

These early operational and aesthetic improvements laid a solid foundation for the property’s transformation, elevating its functionality and appeal in the competitive Northern Liberties market and paving the way for the next phase of renovations in January 2020.

January 2020 – First-floor renovations

Once the lease ended for the inherited first-floor tenant, we began our planned updates to transform the space into a more modern, desirable apartment. During this transition period, a few friends rented the unit temporarily, which allowed us to generate some income during the downtime and offset holding costs.

The improvements to the first-floor unit included updated appliances, fresh paint, and new fixtures, creating a brighter and more inviting space. The work didn’t stop at the interior, though—outside, we tackled a major cleanup of the patio area to create an appealing outdoor space for tenants. One of the biggest challenges in this process was removing a large tree that had become infested with Lantern Flies, creating an unexpected (and memorable) obstacle. Dealing with the pest problem added an extra layer to the project, but the results were well worth it. Once the tree was removed, the patio became a clean and functional space, adding additional appeal to the apartment. Additionally, we added a privacy fence, enhancing the overall value and attractiveness of the patio.

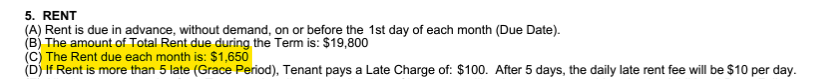

With these improvements, we listed the unit at a competitive market rental price and successfully leased it for $1,650 per month—exceeding our fully stabilized projections of $1,600 and significantly higher than the $1,410 rent paid by the previous tenant (in-place rent at acquisition).

Since the renovation, the unit has continued to appreciate in rental value, and it is currently leased at $1,750 per month. The same tenant has remained in the unit since the upgrades were completed, underscoring the success of our efforts to create a comfortable and attractive living space. This stability not only contributes to consistent cash flow but also validates our value-add strategy in attracting quality tenants and retaining them over the long term.

Fast forwarding a bit…

March 2021 – Second-floor renovations

Almost 2 years post-acquisition, the inherited second-floor tenant finally moved out. Immediately, we began a comprehensive renovation of the second-floor apartment, one of the most significant upgrades in the property. The goal was to bring the unit up to modern standards with improvements that would appeal to tenants seeking both functionality and style. We installed brand-new appliances in the kitchen, applied fresh paint throughout the unit to brighten the space, and added updated countertops, creating a more polished and attractive environment. Additionally, we upgraded the HVAC system with new window units to improve cooling efficiency, ensuring year-round comfort for future tenants.

Another key focus of this renovation was installing an in-unit washer and dryer—an amenity highly valued by tenants. To accommodate the washer and dryer, we had to repurpose an old water connection in the half bath, which required removing an existing closet insert and repositioning the toilet to fit the new setup. Although this reconfiguration took extra effort, it significantly enhanced the unit’s appeal by adding a convenient, in-demand feature.

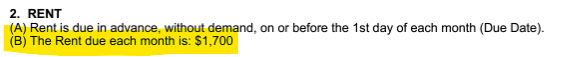

Once completed, the renovations allowed us to secure a lease for $1,700 per month, exceeding both our fully stabilized projection of $1,600 and the $1,350 rent previously paid by the inherited tenant (in-place rent at acquisition). This higher rental rate showcased the value added through quality upgrades and thoughtful design—but the second floor apartment had even greater potential waiting to be unlocked…

June 2022 – Second-floor Airbnb conversion and third-floor upgrades

With the property already outperforming expectations, we decided to take things to the next level.

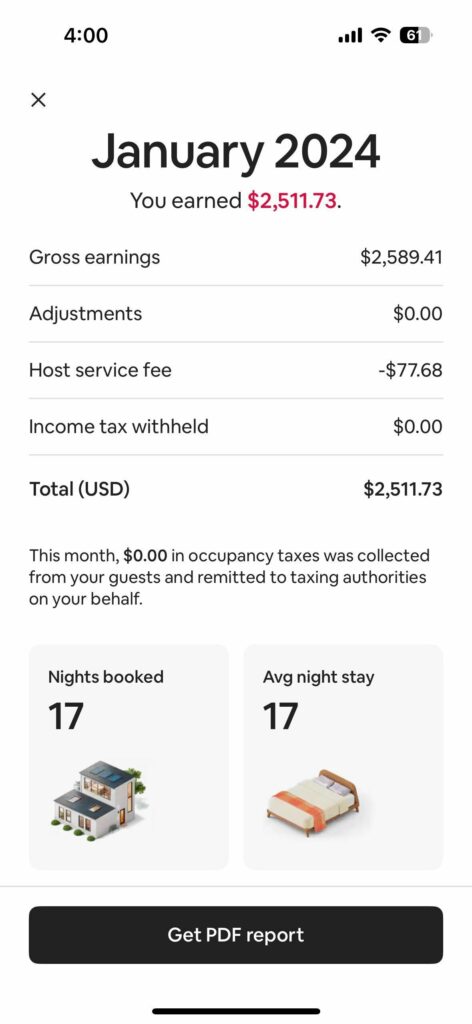

After extensive market research, we identified an opportunity to boost revenue by transitioning the second-floor unit into a 30+ day Airbnb rental, a format that met zoning requirements while capturing a higher-paying tenant base. Our initial projections indicated that this medium-term rental would yield approximately $2,000 per month—up from the $1,700 previously achieved, and a substantial increase from the $1,350 in-place rent at acquisition.

To optimize the Airbnb setup, we invested time and resources into furnishing the unit with premium items, creating a comfortable and appealing environment for guests. Additionally, we established a streamlined process for Airbnb operations, including automated cleaning schedules, guest communication protocols, and operational efficiencies to ensure a seamless experience for tenants.

Once the apartment was live on the Airbnb platform, we immediately achieved rents between $2,300 and $2,500 per month, averaging around $2,400 – up significantly from initial projections ($2,000), the $1,700 previously achieved, and in-place rents at acquisition ($1,350). This shift to a higher-yielding medium-term rental proved to be a huge value-add, nearly doubling the rental income from the inherited tenant’s original rent.

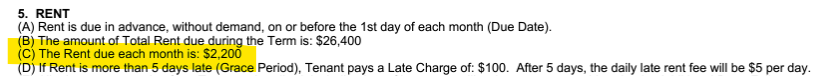

After moving out of the third-floor unit (to relocate to California), we completed light upgrades on the apartment, which already had desirable features like exposed brick in the family room and one of the bedrooms, an in-unit washer and dryer, and fantastic city views. We enhanced the unit with fresh paint, a few new appliances, and updated fixtures, giving it a refreshed, modern look. These upgrades allowed us to raise the rent to $2,200, surpassing the initial stabilization projection of $1,800—the rate I originally rented the apartment for during my house-hacking phase. The unit’s enhanced appeal and functionality continued to drive demand, and it is now leased at $2,300—significantly exceeding business plan projections!

January 2023 – Stabilization

By January 2023, three and a half years post-acquisition, the Northern Liberties Apartments reached full stabilization. Throughout this period, the team at KWM Capital executed a comprehensive value-add strategy, transforming each unit to meet market demands, implementing a successful medium-term Airbnb rental for the second-floor unit, and introducing in-house property management to streamline operations. These efforts collectively improved tenant satisfaction, boosted operational efficiency, and maximized the property’s income potential.

Achieving stabilization was the culmination of a meticulously planned business strategy laid out at the beginning of the project. The four key components of the business plan—targeted renovations, in-house property management, operational efficiencies, and rent stabilization—were successfully executed.

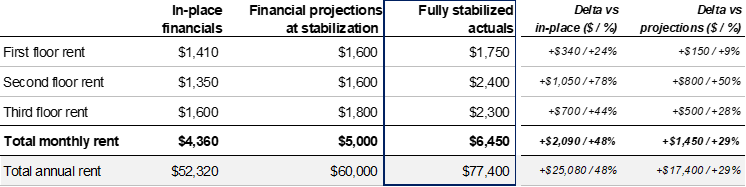

The results speak for themselves so to summarize, please see below comparison of the in-place rents at acquisition versus the fully stabilized rents achieved by the end of the project:

As you can see, after executing our business plan, we raised total monthly rental income from $4,360 at acquisition to $6,450 at stabilization, reflecting a 48% increase driven by targeted renovations and effective asset management. The total renovation cost for this project was $41,000 (funded by bridge debt and cash flow), resulting in a return on cost of 61%—a testament to the strong value created.

In December 2021, we opted to refinance the property at a $750,000 valuation to take advantage of favorable interest rates, just months before a sharp rise in rates. This refinance allowed us to repay the bridge debt, effectively making the renovations cost-neutral.

Lastly, in September 2023, we conducted a cost segregation study to capture the 80% bonus depreciation available under current tax laws. Cost segregation allows real estate investors to reclassify certain property components into shorter depreciation schedules, resulting in significant tax savings. This bonus depreciation provides an accelerated benefit, allowing investors to offset more of their income and increase after-tax cash flow. More to come on this in future blog posts.

Performance Metrics and Value Creation

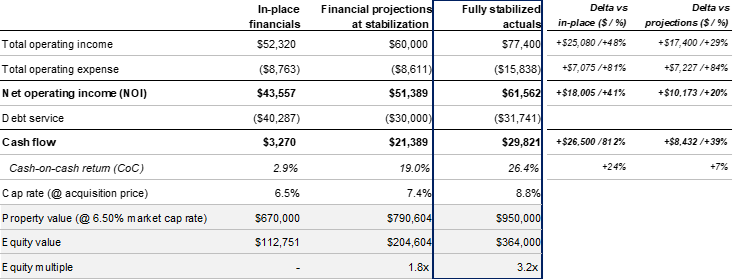

At stabilization, the property achieved a Net Operating Income (NOI) of $61,562, with annual cash flow now totaling $29,821—significantly exceeding both our initial financial projections and in-place acquisition figures. This cash flow results in a strong 26.4% cash-on-cash return, generating substantial income each year for investors. Based on a 6.50% exit cap rate, the property’s value at stabilization is $950,000, totaling an equity value of $364,000 for investors which represents a 3.2x equity multiple or $251,249 in profit.

For a clearer perspective on performance and valuation, below is a detailed comparison of our initial financial projections at acquisition versus the fully stabilized actuals, highlighting both the dollar and percentage differences relative to in-place and projected values:

Despite the strong valuation and impressive return metrics, we’ve decided to hold onto the property. The robust cash-on-cash returns, combined with the continued growth and potential of the Northern Liberties neighborhood, offer significant upside. By holding the property, investors can continue to enjoy steady cash flow and benefit from future appreciation as the area evolves with ongoing developments and increased demand.

This decision aligns with our long-term investment philosophy at KWM Capital: focusing on assets that not only generate immediate returns but also offer sustained growth over time. The Northern Liberties Apartments exemplifies the success of a well-executed value-add strategy, with renovations, operational improvements, and market insights all coming together to create a high-performing, stabilized asset.

Letting go of this one would certainly be difficult—it’s a testament to the power of thoughtful planning and strategic execution in real estate investing. For now, we’re excited to watch this property continue to thrive as we apply the lessons learned here to future projects.

Lessons learned & Key takeaways

Reflecting on this journey, I am often reminded how far I’ve come—from countless hours spent absorbing real estate content during long drives, to immersing myself in Philly’s neighborhoods through “market research” in coffee shops and bars (haha), to cutting down a tree myself with a handsaw, or moving water-filled toilets, to transforming apartments. Every step, no matter how big or small, contributed to the foundation of KWM Capital and the establishment of a repeatable, proven strategy. Each moment taught me something invaluable, and together, they’ve shaped both my approach to investing and my vision for the future.

This deal hopefully helps validate the KWM Capital Way, proving that a well-executed value-add strategy can deliver exceptional returns for our investors. Achieving a 3x equity multiple in under five years, while also providing significant cash-on-cash returns, underscores the power of thoughtful investment, strategic upgrades, and proactive asset management. The success of this deal isn’t just a testament to hard work; it’s a confirmation that the principles we hold at KWM Capital work.

Looking ahead, we’re applying the lessons learned here to every deal we pursue. The ability to adapt when financing terms shift, the value of rigorous market analysis, and the importance of operational efficiencies all strengthen our investment thesis. At KWM Capital, our commitment remains the same: to uncover hidden value in properties, optimize performance, and create meaningful investment opportunities. This journey has reaffirmed our dedication to providing our investors with the same opportunities for growth and passive income that inspired the firm’s founding.

Up next

Thank you for taking the time to follow along with this case study. Your interest and support truly mean so much to me, and I’m incredibly grateful to have the opportunity to share this journey with you. It’s been a pleasure to pull back the curtain and give you an inside look at the strategies, challenges, and successes that have shaped this project.

At KWM Capital, our mission is to empower investors by providing both exceptional opportunities and valuable insights into the world of real estate investing. This means we are committed to continuing this dialogue by sharing informational resources and other educational real estate content. Whether you’re a seasoned investor or just beginning to explore multifamily real estate, we’re here to offer guidance, answer your questions, and help you achieve your investment goals.

If you’re ready to explore partnering with KWM Capital, we’d love to connect with you. If you know someone who would benefit from this case study, feel free to share it with them! You can also encourage them to subscribe to our newsletter to stay updated on the latest resources, insights, and investment opportunities.