“The journey of a thousand miles begins with a single step.” — Lao Tzu

My journey in real estate investing wasn’t a straight path to overnight success; it was years in the making. While my early investments came with quick decision-making, I didn’t jump into my first multifamily purchase on a whim. That seemingly swift, 24-hour decision to purchase my first multifamily real estate investment was built on countless hours of work, educating myself with every real estate resource I could find. From listening to Bigger Pockets podcasts to old Rich Dad Poor Dad Real Estate Education CDs my dad kept in his car, I immersed myself in the fundamentals and strategies of real estate investing. During the summer before my senior year of college, on my commute to an internship in Malvern, PA, I turned my car into a personal classroom, consuming as much real estate content as possible. I’d daydream about my first investment and would practice underwriting deals on an Excel spreadsheet that, in hindsight, was embarrassingly basic.

Looking back at my prior investments, it may seem like they happened in the blink of an eye. In reality, my first multifamily property acquisition was five years in the making and wasn’t the result of luck. It was driven by strategic planning, hard work, and a willingness to learn at every step of the investment timeline. I’ve always pushed myself to keep learning and improving, striving for efficiency and excellence in every deal.

As I honed my skills, I often found myself in conversations with family, friends, and acquaintances who were eager to invest in real estate but felt overwhelmed by its complexities. Many were interested but lacked the time or passion to dive into the details of finding, managing, and improving properties. I saw an opportunity to bridge that gap—a way to help busy professionals benefit from real estate investing without getting bogged down in the day-to-day challenges and expertise needed.

This is why I started KWM Capital. My vision was simple yet impactful: to bring folks alongside me on this journey, sharing both the rewards and the insights that make real estate investing such a powerful tool for building wealth. In doing this, I want to demystify the process. My goal is to showcase exactly how KWM Capital can identify an underperforming asset, implement value-add strategies, and maximize returns for investors.

And that brings me to this case study. In this example, you’ll see how we approach a deal, from acquisition to renovation to stabilization. I’m excited to pull back the curtain and give you a look at the KWM Capital Way. If you’d like to learn more about how you can partner with KWM Capital or explore similar investment opportunities, schedule a call with me here. Know someone who might be interested? Feel free to forward this case study to them or have them subscribe to our newsletter.

Let’s get into it!

Investment summary and timeline

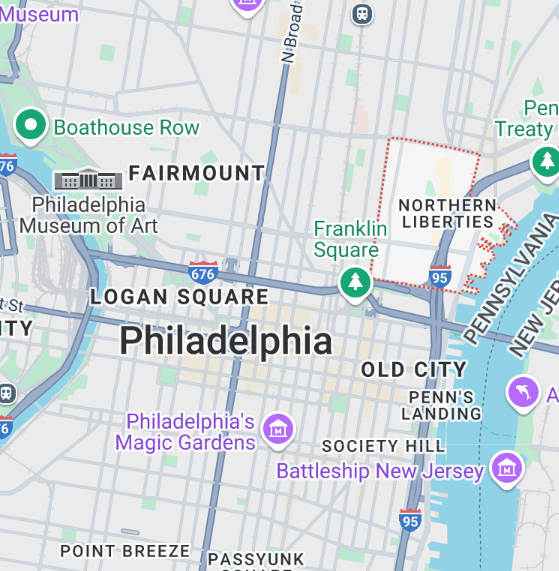

Northern Liberties Apartments, a 3-unit apartment community located in Philadelphia’s vibrant Northern Liberties neighborhood, represented an exceptional investment opportunity for my first multifamily deal. This area, known for its cultural vibrancy and recent revitalization, has become a magnet for young professionals, artists, and entrepreneurs over the last 10 years. With its eclectic mix of restaurants, galleries, and green spaces, Northern Liberties has experienced rapid growth, which is exactly what I was looking for in my first deal.

The property itself had great bones and clear potential for improvement. The first-floor unit consisted of a 1-bedroom, 1-bath layout with an office and a spacious outdoor patio, while the second-floor unit featured a 1-bedroom, 1.5-bath configuration with a large outdoor deck. Both units were significantly under market rent, presenting immediate upside potential through effective asset management. The third floor, a 2-bedroom, 1-bath unit with exposed brick and city views, was delivered vacant, providing the perfect opportunity for house-hacking. Recognizing the property’s untapped potential, KWM Capital set out to reposition this triplex into a high-performing asset.

Project overview and performance highlights

- Property type: 3-unit multifamily apartment community

- Strategy: Value-add

- Acquisition date: May 2019

- Purchase price: $670,000 at a going-in cap rate of 6.50%

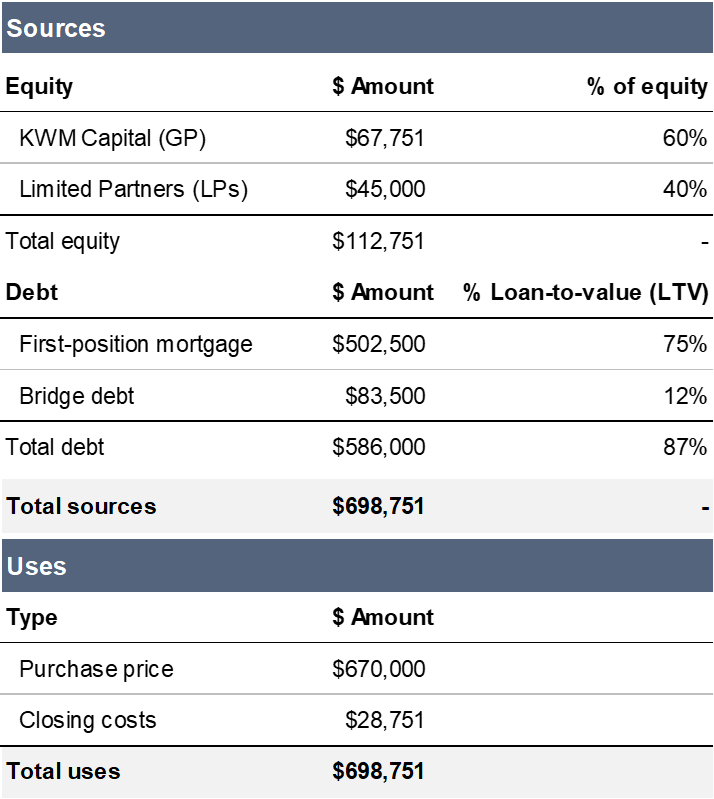

- Acquisition financing: 87% LTV, secured through a combination of a first-position mortgage at 4.38% interest (30-year amortization) and $83,500 bridge loan

- Total equity investment: $112,751 (60% KWM Capital, 40% LPs)

- Renovation cost: ~$41,000 (funded by bridge debt and cash flow)

- Key upgrades: Implementation of in-house property management, operational efficiencies, full unit renovations, and second-floor unit Airbnb conversion

- Refinance: December 2021, refinanced at 75% LTV with a 3.88% interest rate (30-year amortization), reflecting a $750,000 property valuation. Refi repaid bridge debt, a portion of which had funded renovations

- Annual rent roll at acquisition: $52,320

- Annual rent roll at stabilization: $77,400 (+48% from acquisition)

- Net operating income (NOI) increase: +41% from acquisition

- Cash-on-cash return (CoC) at stabilization: 26%

- Property value at stabilization: $950,000 (assuming exit cap rate of 6.50%)

- Projected return: 1.8x equity multiple or $204,604 ($91,854 profit)

- Actual return: 3.2x equity multiple or $364,000 ($251,249 profit)

How we found it

There are numerous government programs and incentives designed to encourage affordable housing investments. These can include tax credits, grants, and low-interest loans, which can significantly reduce the financial burden on investors. By leveraging these incentives, KWM Capital maximizes the profitability of our projects while supporting government efforts to address housing shortages.

Why we liked it (investment highlights)

Northern Liberties Apartments was a homerun investment opportunity for several compelling reasons:

- Prime location: Situated in one of Philadelphia’s fastest-growing neighborhoods, the property offered proximity to the area’s thriving social and cultural scene (2nd Street Northern Liberties), public transit, major highways (I-95), and downtown Philadelphia. Northern Liberties’ growth trajectory, combined with new development, ensured strong housing demand and rising rental rates

- Well-maintained: The previous owner kept the building in good condition, with little deferred maintenance needed. This would allow us to focus renovation efforts on targeted, high-value improvements to maximize rents

- Strong fundamentals: The property was purchased at a below-market price, offering built-in equity at acquisition. Additionally, it generated positive cash flow from day one, providing financial stability and flexibility during renovation periods when units were temporarily offline

- Immediate upside: All three units were significantly below market rents, with the third floor delivered vacant, presenting a clear opportunity to boost cash flow and drive forced value appreciation through strategic rent adjustments and occupancy optimization

- Favorable target returns: Through a carefully executed value-add strategy, we projected a significant increase in rents, driving both cash flow and property value growth. Utilizing conservative underwriting, we initially targeted a 19% cash-on-cash return upon full stabilization, with an anticipated equity multiple of 2.0x by the end of 2022—effectively doubling the initial investment over the hold period

Business plan

The business plan for Northern Liberties Apartments was straightforward:

- Targeted renovations: We focused on high-impact unit interior upgrades to enhance tenant appeal while maintaining cost efficiency. These included updating appliances, fixtures, and finishes, as well as making strategic improvements to common areas and outdoor spaces

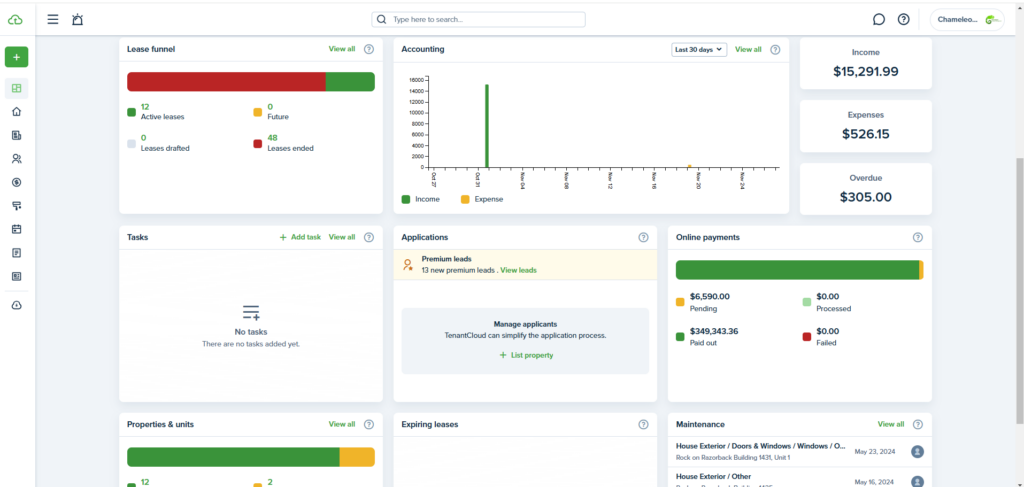

- In-house property management: Implementing in-house property management (Chameleon Property Management) allowed for hands-on oversight of asset management

- Operational efficiencies: Leveraging property management software streamlined processes such as rent collection, lease management, and maintenance requests. These efficiencies helped minimize operational costs and reduce vacancy rates

- Rent stabilization: Bringing all units to market-rate rents was a key priority, achieved through targeted upgrades and improved tenant experiences

- Cost segregation and tax efficiency: Conduct a cost segregation study to capture bonus depreciation, maximizing after-tax returns for investors

How we funded it

Financing for the property required creativity to close the deal within 45 days:

- Debt: Secured a first-position mortgage at 75% Loan-to-Value (LTV) with a 4.38% interest rate and 30-year amortization. To address last-minute changes in lender terms, KWM Capital obtained an $83,500 bridge loan, ensuring sufficient funds for closing and renovations. This brought the total financing to 87% LTV

- Equity: The remaining 13% of the capital stack, totaling $112,751, was funded through a combination of 60% investment from KWM Capital and 40% from LP contributions

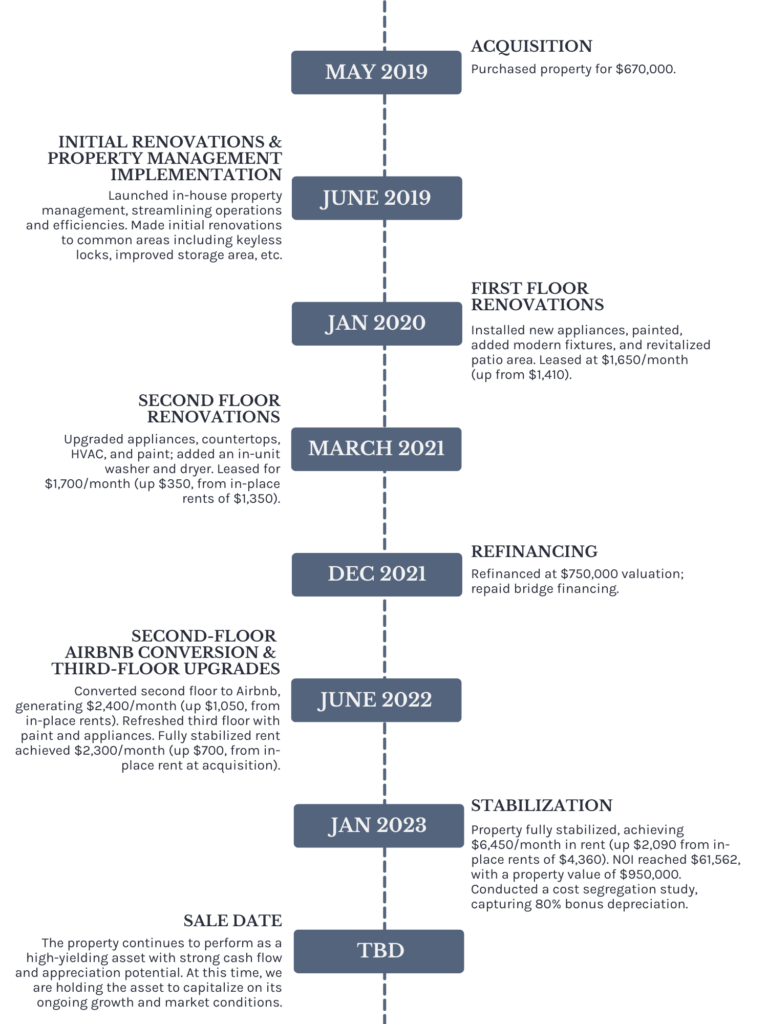

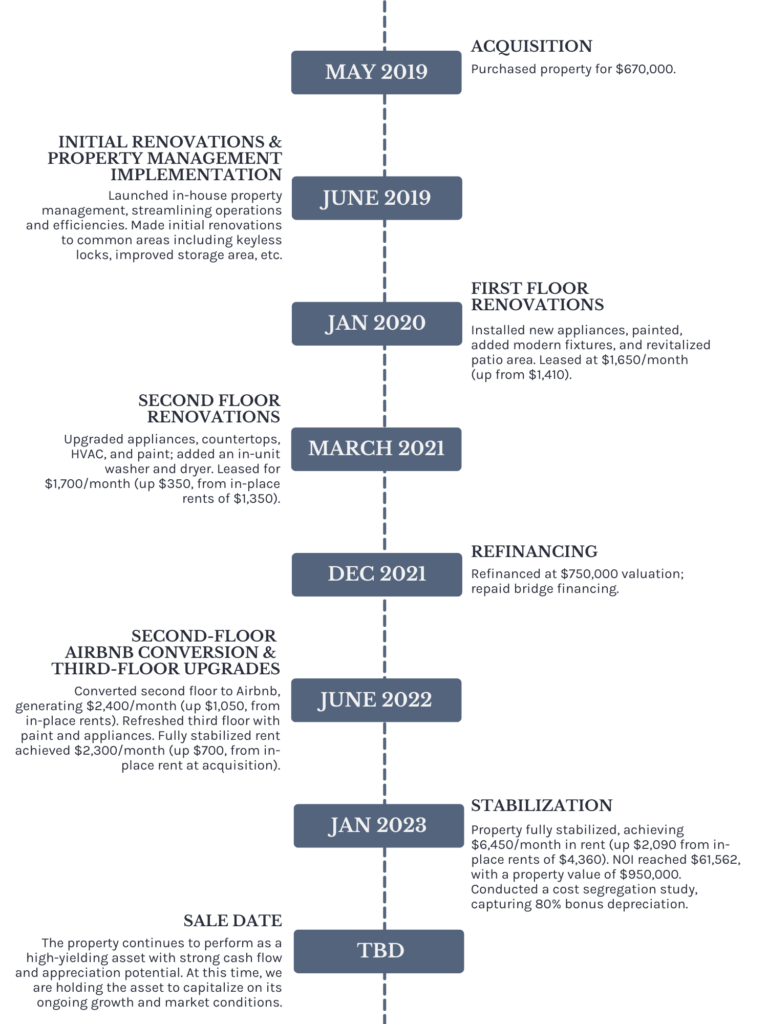

Investment timeline

Every real estate investment has its own unique journey. From acquisition to stabilization, we took strategic steps to maximize the property’s value. Below you’ll find a timeline of key milestones that highlight the transformation and path to achieve stabilization.

Before and after photos

Click here for the PDF version

Market selection to acquisition closing

Market selection and deal identification

Even before 2019, Philadelphia had long been on my radar as an excellent location for my first multifamily real estate investment. The city offered the perfect mix of relative affordability, strong rental demand, market growth, and accessibility to my lifestyle at the time, making it an ideal place to implement my dual-purpose strategy of house hacking. Living in one unit while renting out the others would not only reduce my living expenses but also provide invaluable, hands-on experience in managing the asset—a critical element for my first investment, where I could directly address and learn from every challenge that came my way.

Philadelphia’s rental demand was steadily increasing, driven by a growing population, an influx of young professionals, and a strong job market. Among its many vibrant neighborhoods, I specifically targeted a few up-and-coming areas that showed strong growth potential, including Northern Liberties.

With six months of tireless effort and local immersion, I spent many weekends in the neighborhoods I was targeting, often accompanied by my real estate mentors, observing the subtle details that made each area unique. I hung out in local coffee shops, visited restaurants and bars, and walked through multifamily properties on the market. Immersing myself in the market allowed me to better understand the demographics and dynamics of each neighborhood, which sharpened my underwriting skills. I began noticing factors that would add or subtract value from each potential deal—whether it was proximity to public transportation, neighborhood amenities, or the types of tenants the area attracted. These insights became invaluable when evaluating properties.

During this time, I slept on friends’ couches to maximize my time in the area (while also enjoying the local nightlife!) and focused all my weekend time on finding an investment opportunity. I analyzed dozens of deals and even had an offer accepted on another property, only for the deal to fall apart during inspection. Despite the setbacks, the experience taught me valuable lessons in deal hunting and prepared me for when the right opportunity came along.

After months of searching, Northern Liberties Apartments emerged as a standout opportunity. I discovered it through a Zillow auto alert I had set up, and it immediately caught my attention. Its unoccupied third-floor unit made it a perfect house-hacking candidate, while the other units offered significant potential for growth through strategic renovations and rental increases.

The property was located in one of my target neighborhoods, Northern Liberties, situated just north of Center City. The area was undergoing a wave of revitalization, bringing in new businesses, restaurants, and residential developments. The momentum in the area was driven by it’s excellent location within the city. It offered convenient access to public transportation, major highways like I-95 and the Pennsylvania Turnpike, and downtown Philadelphia. Local attractions, including the restaurants and bars on 2nd Street and the new development of the “Piazza,” added to its appeal, making it highly desirable for renters. The growing demand for housing in the neighborhood provided a strong foundation for long-term value appreciation.

Equally compelling was the condition of the property. Unlike many older buildings in the area, this triplex had been well-maintained by its previous owner. With minimal deferred maintenance required, we could focus on targeted upgrades that would unlock the property’s potential without the need for an extensive and costly overhaul. This allowed for a faster path to increasing net operating income and enhancing the overall value of the property.

The most exciting aspect of the deal was the financial upside. All three units were significantly under market rent, and the vacant third-floor unit presented an immediate opportunity to generate additional income. The asking price was also below market value, creating built-in equity from the acquisition. The combination of immediate positive cash flow and the ability to reposition the property through strategic improvements made it a home run.

Recognizing its potential, I moved quickly. Within hours of its listing, I toured the property and submitted an offer at the asking price of $670,000. The offer was accepted the same day, marking a pivotal moment in my real estate journey. The days that followed confirmed the strength of the deal. Competing bids came in well above the asking price after ours was accepted, validating the built-in equity and strong fundamentals of the property. It was clear that this deal had all the right elements for success, but we were just getting started!

Initial financial projections

Below is a summary of the initial financial projections that were finalized during the due diligence phase once the deal was under contract.

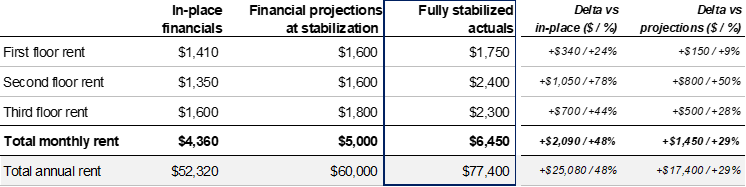

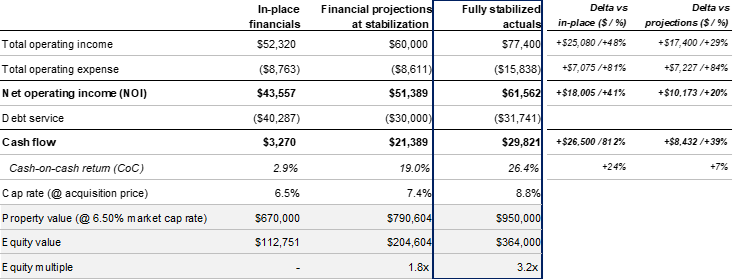

At acquisition, cash flow was moderate, with initial rents totaling $4,360 per month (or $52,320 annually) across the three units. This resulted in a monthly cash flow of $3,270 after accounting for operating expenses and debt service, yielding a 2.9% cash-on-cash return and a 6.50% going-in cap rate based off the purchase price.

Our business plan projected stabilization by the end of 2021 with rents achieving targeted market-rate rent adjustments for each unit. We conservatively anticipated raising rents to $1,600 per month on the first and second floors, and $1,800 on the vacant third floor, pushing total annual operating income to $60,000. With net operating income increasing to $51,389, the property would achieve a 7.4% cap rate at stabilization. Annual cash flow would be boosted to $21,389, raising the cash-on-cash return to 19.0%. In year 3 of our projection model (2021), we estimated a refinance to repay the bridge loan and support further property improvements. Given the solid cash-on-cash returns and our goal to hold this asset indefinitely, we did not assume a future sale of the property. We viewed Northern Liberties Apartments as a long-term investment that will continue to generate steady income and appreciation, making it a valuable asset to retain in our portfolio.

Due diligence period

Upon signing the purchase and sale agreement at an acquisition price of $670,000, we immediately initiated a comprehensive due diligence process. We initially set a 60-day closing period, however, at the seller’s request, we negotiated to shorten the timeline to 45 days. This accelerated closing required us to move quickly, so we immediately initiated a comprehensive due diligence process. This included a thorough review of the property’s financials, a detailed physical inspection, title, zoning and environmental checks, and validation of the property’s overall condition. The goal in any due diligence period is to identify any potential risks early and confirm that the property continues to align with our initial investment thesis.

Physical due diligence

Although there were a few small maintenance items flagged during the inspection, there were no major issues in the financial or physical inspections. These minor issues were addressed by negotiating a $1,000 credit from the seller at closing, a small win that still allowed us to preserve capital for the larger renovations planned. The only major issue was an angry dog and an even angrier tenant who was unaware of the physical apartment inspection that was set to take place!

The capital stack

Concurrent with the due diligence workstreams, we moved quickly to secure both equity and debt financing. We reached out to limited partners to raise the necessary equity and engaged with lenders to structure the debt portion of the capital stack.

Securing the equity portion of the capital stack was a critical step in closing this deal, and I was fortunate to receive the backing of my immediate family. After the purchase and sale agreement was signed, I presented the investment opportunity to them, explaining the potential of Northern Liberties Apartments and detailing the business plan. Seeing the opportunity, as well as believing in my vision and capability to execute the business plan, my parents and brother committed their support. With $67,751 of my own funds (60% of the equity), my family stepped in to help close the gap by contributing $45,000 (40% of the equity). Their decision to invest wasn’t just about the numbers—it was also a testament to the trust they place in me and my ability to execute the vision KWM Capital laid out. Having my family as initial investors was both a privilege and a responsibility, and very humbling and motivating; it reinforced the responsibility I felt to make this deal a success and honor the trust they placed in me.

Debt financing for the acquisition was structured to maximize leverage to optimize returns. Initially, our underwriting targeted a 90% loan-to-value (LTV) based on early discussions with lenders, anticipating a very low down payment on the property. The original debt component we agreed on with the mortgage company, LoanDepot was a first-position mortgage of $603,000 with an interest rate of 4.38% interest and a 30-year amortization—favorable terms that would support our business plan. However, as we moved through the financing process, the lender revised their terms multiple times, eventually reducing the LTV needed to close to 75% (mortgage amount of $502,500) just five days before closing. This last-minute change nearly jeopardized the deal, requiring a larger equity contribution than originally planned and creating an immediate funding gap.

Rather than abandon a home run deal, we decided to get creative with the financing to bridge the gap. We secured a $67,000 bridge loan from Republic Bank, structured as a 15-year loan with a 5.49% interest rate, which provided additional leverage without overextending the capital stack. Additionally, I arranged a $16,500 loan from my parents at a 3.65% interest rate over five years. This support from my family, both as equity and debt investors—will never be forgotten.

With a total of $83,500 of bridge debt in place, we successfully brought the overall LTV back up to 87%, close to our original 90% target. This creative financing solution enabled us to close the deal on time and provided access to capital for planned renovations. Navigating these last-minute changes within a tight 45-day closing period was challenging and taught me invaluable lessons in flexibility and problem-solving. By leveraging both conventional financing and family support, we were able to finalize the acquisition and move forward with our value-add business plan, transforming a challenging financing situation into a foundation for future success.

Acquisition closing

With the creative financing in place, we were able to close the deal within a tight 45-day timeline. The journey to close Northern Liberties Apartments wasn’t without its challenges, but through persistence, flexibility, and the support of both conventional financing and family contributions, we successfully completed the acquisition. This experience reinforced the importance of adaptability in real estate investing—when faced with obstacles, sometimes the best opportunities come from finding new solutions. With the acquisition finalized, we were now fully equipped to implement our value-add strategy and unlock the property’s full potential, setting the stage for a successful investment and rewarding those who believed in the vision from the start.

Post-acquisition renovations to property stabilization

Introduction to the renovation & value-add process

Once the acquisition was finalized, KWM Capital immediately began executing the business plan with a clear objective: increasing rents and decreasing expenses to maximize NOI, ultimately driving forced property value appreciation.

We prioritized high-impact upgrades to both individual units and common areas, creating a modern, attractive, and well-functioning property that appealed to tenants and stood out in the competitive Northern Liberties market. Every improvement was carefully selected to enhance the property’s income potential while maintaining cost efficiency. These renovations were further supported by operational efficiencies, including the introduction of in-house property management, which provided greater control over expenses and streamlined day-to-day operations.

Below is a step-by-step guide to the asset management efforts, detailing the value-add improvements made at each stage. But before diving in, let’s review the timeline from Part 1.

June 2019 – Initial renovations and property management implementation

Immediately after closing in late May of 2019, we implemented our in-house property management team, Chameleon Property Management, to take a hands-on approach in managing the property. With Chameleon Property Management, we introduced TenantCloud, a robust property management software that streamlined processes and improved tenant relations. Implementing TenantCloud enhanced rent collection efficiency, allowed tenants to submit maintenance requests directly through the platform, and facilitated swift communication between tenants and management / KMW Capital—all of which contributed to a higher standard of service and smoother operations. This software also improved the leasing process by allowing us to deeply vet tenants, which reduced vacancy rates in the future.

Concurrently with the launch of Chameleon Property Management, we began upgrades to the common areas to enhance security, functionality, and the overall appeal of the property. One of the first improvements was the installation of keyless entry locks, adding an advanced level of access control for tenants and the property management team. These locks provided convenient and secure access, allowing us to set temporary guest codes for maintenance staff, monitor lock battery levels, and enhance the overall tenant experience. This sophisticated technology offered both convenience and peace of mind, adding significant value to tenants.

To further improve the aesthetics of the common areas, we added artwork depicting iconic Philadelphia scenes, adding a welcoming, local touch to the property. Additionally, we installed a large mirror in the second-floor hallway—a practical feature that tenants could use and enjoy, bringing an extra sense of style and personality to the space. These thoughtful enhancements contributed to a more inviting environment, creating a positive first impression for current and prospective tenants alike.

In addition to these interior common area upgrades, we also undertook a major cleanup of the basement, which had been cluttered with old, unused items. We cleaned and organized the space, creating dedicated storage areas where tenants could keep personal belongings such as bikes and seasonal items. This additional storage was a valuable amenity, providing tenants with much-needed extra space and enhancing the property’s overall appeal to prospective renters.

In terms of exterior upgrades, we repointed the brickwork on the side of the building to protect the property’s interior from potential water penetration, which can lead to structural damage and costly repairs if left unaddressed. By renewing the mortar between bricks, we improved the building’s durability and ensured long-term protection against the elements, adding both value and longevity to the structure. In the outdoor side alley trash area, we made organizational improvements to facilitate proper waste disposal, making it more efficient and accessible for all residents.

Lastly, and perhaps most importantly, during this period we leased the vacant third-floor unit at $1,800 per month. I personally moved into the unit with a roommate, achieving my goal of house hacking. This strategy not only maximized rental income but also allowed me to maintain an on-site presence, which supported both property management and fostered a stronger connection with the tenant community. Additionally, as existing leases turned over, we introduced pet rent as a new income stream—offering a pet-friendly option for tenants while further increasing the property’s revenue.

These early operational and aesthetic improvements laid a solid foundation for the property’s transformation, elevating its functionality and appeal in the competitive Northern Liberties market and paving the way for the next phase of renovations in January 2020.

January 2020 – First-floor renovations

Once the lease ended for the inherited first-floor tenant, we began our planned updates to transform the space into a more modern, desirable apartment. During this transition period, a few friends rented the unit temporarily, which allowed us to generate some income during the downtime and offset holding costs.

The improvements to the first-floor unit included updated appliances, fresh paint, and new fixtures, creating a brighter and more inviting space. The work didn’t stop at the interior, though—outside, we tackled a major cleanup of the patio area to create an appealing outdoor space for tenants. One of the biggest challenges in this process was removing a large tree that had become infested with Lantern Flies, creating an unexpected (and memorable) obstacle. Dealing with the pest problem added an extra layer to the project, but the results were well worth it. Once the tree was removed, the patio became a clean and functional space, adding additional appeal to the apartment. Additionally, we added a privacy fence, enhancing the overall value and attractiveness of the patio.

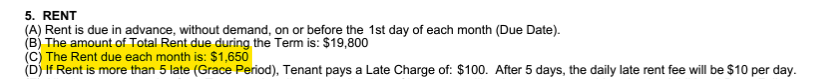

With these improvements, we listed the unit at a competitive market rental price and successfully leased it for $1,650 per month—exceeding our fully stabilized projections of $1,600 and significantly higher than the $1,410 rent paid by the previous tenant (in-place rent at acquisition).

Since the renovation, the unit has continued to appreciate in rental value, and it is currently leased at $1,750 per month. The same tenant has remained in the unit since the upgrades were completed, underscoring the success of our efforts to create a comfortable and attractive living space. This stability not only contributes to consistent cash flow but also validates our value-add strategy in attracting quality tenants and retaining them over the long term.

Fast forwarding a bit…

March 2021 – Second-floor renovations

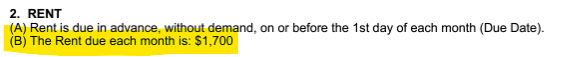

Almost 2 years post-acquisition, the inherited second-floor tenant finally moved out. Immediately, we began a comprehensive renovation of the second-floor apartment, one of the most significant upgrades in the property. The goal was to bring the unit up to modern standards with improvements that would appeal to tenants seeking both functionality and style. We installed brand-new appliances in the kitchen, applied fresh paint throughout the unit to brighten the space, and added updated countertops, creating a more polished and attractive environment. Additionally, we upgraded the HVAC system with new window units to improve cooling efficiency, ensuring year-round comfort for future tenants.

Another key focus of this renovation was installing an in-unit washer and dryer—an amenity highly valued by tenants. To accommodate the washer and dryer, we had to repurpose an old water connection in the half bath, which required removing an existing closet insert and repositioning the toilet to fit the new setup. Although this reconfiguration took extra effort, it significantly enhanced the unit’s appeal by adding a convenient, in-demand feature.

Once completed, the renovations allowed us to secure a lease for $1,700 per month, exceeding both our fully stabilized projection of $1,600 and the $1,350 rent previously paid by the inherited tenant (in-place rent at acquisition). This higher rental rate showcased the value added through quality upgrades and thoughtful design—but the second floor apartment had even greater potential waiting to be unlocked…

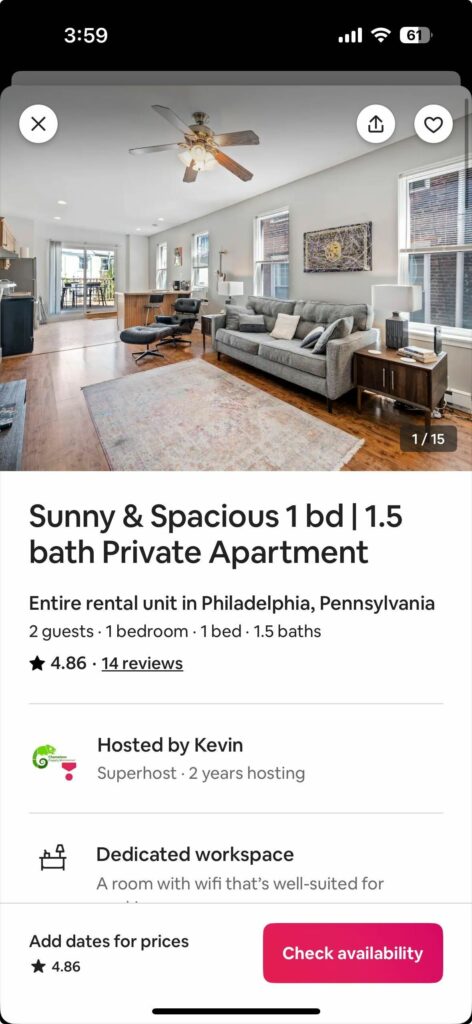

June 2022 – Second-floor Airbnb conversion and third-floor upgrades

With the property already outperforming expectations, we decided to take things to the next level.

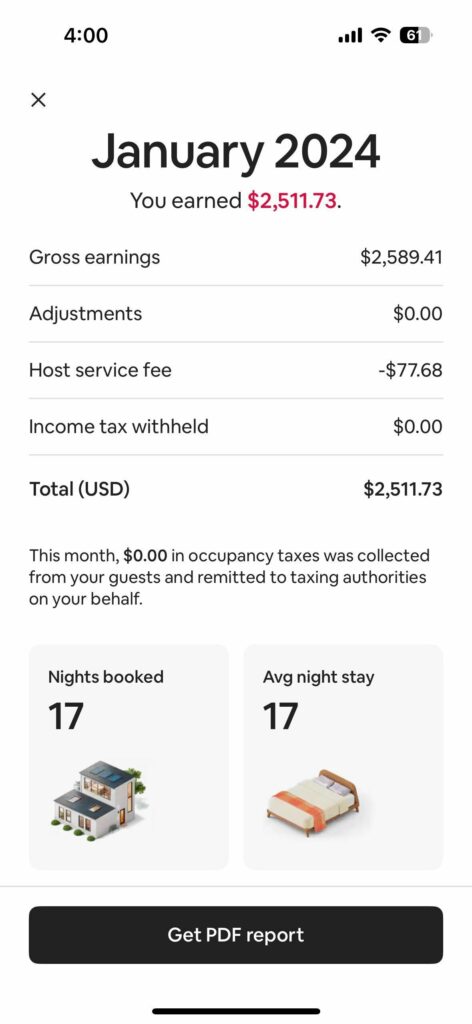

After extensive market research, we identified an opportunity to boost revenue by transitioning the second-floor unit into a 30+ day Airbnb rental, a format that met zoning requirements while capturing a higher-paying tenant base. Our initial projections indicated that this medium-term rental would yield approximately $2,000 per month—up from the $1,700 previously achieved, and a substantial increase from the $1,350 in-place rent at acquisition.

To optimize the Airbnb setup, we invested time and resources into furnishing the unit with premium items, creating a comfortable and appealing environment for guests. Additionally, we established a streamlined process for Airbnb operations, including automated cleaning schedules, guest communication protocols, and operational efficiencies to ensure a seamless experience for tenants.

Once the apartment was live on the Airbnb platform, we immediately achieved rents between $2,300 and $2,500 per month, averaging around $2,400 – up significantly from initial projections ($2,000), the $1,700 previously achieved, and in-place rents at acquisition ($1,350). This shift to a higher-yielding medium-term rental proved to be a huge value-add, nearly doubling the rental income from the inherited tenant’s original rent.

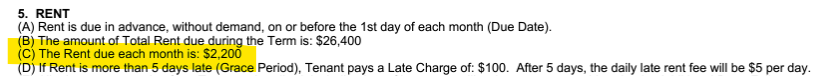

After moving out of the third-floor unit (to relocate to California), we completed light upgrades on the apartment, which already had desirable features like exposed brick in the family room and one of the bedrooms, an in-unit washer and dryer, and fantastic city views. We enhanced the unit with fresh paint, a few new appliances, and updated fixtures, giving it a refreshed, modern look. These upgrades allowed us to raise the rent to $2,200, surpassing the initial stabilization projection of $1,800—the rate I originally rented the apartment for during my house-hacking phase. The unit’s enhanced appeal and functionality continued to drive demand, and it is now leased at $2,300—significantly exceeding business plan projections!

January 2023 – Stabilization

By January 2023, three and a half years post-acquisition, the Northern Liberties Apartments reached full stabilization. Throughout this period, the team at KWM Capital executed a comprehensive value-add strategy, transforming each unit to meet market demands, implementing a successful medium-term Airbnb rental for the second-floor unit, and introducing in-house property management to streamline operations. These efforts collectively improved tenant satisfaction, boosted operational efficiency, and maximized the property’s income potential.

Achieving stabilization was the culmination of a meticulously planned business strategy laid out at the beginning of the project. The four key components of the business plan—targeted renovations, in-house property management, operational efficiencies, and rent stabilization—were successfully executed.

The results speak for themselves so to summarize, please see below comparison of the in-place rents at acquisition versus the fully stabilized rents achieved by the end of the project:

As you can see, after executing our business plan, we raised total monthly rental income from $4,360 at acquisition to $6,450 at stabilization, reflecting a 48% increase driven by targeted renovations and effective asset management. The total renovation cost for this project was $41,000 (funded by bridge debt and cash flow), resulting in a return on cost of 61%—a testament to the strong value created.

In December 2021, we opted to refinance the property at a $750,000 valuation to take advantage of favorable interest rates, just months before a sharp rise in rates. This refinance allowed us to repay the bridge debt, effectively making the renovations cost-neutral.

Lastly, in September 2023, we conducted a cost segregation study to capture the 80% bonus depreciation available under current tax laws. Cost segregation allows real estate investors to reclassify certain property components into shorter depreciation schedules, resulting in significant tax savings. This bonus depreciation provides an accelerated benefit, allowing investors to offset more of their income and increase after-tax cash flow. More to come on this in future blog posts.

Performance Metrics and Value Creation

At stabilization, the property achieved a Net Operating Income (NOI) of $61,562, with annual cash flow now totaling $29,821—significantly exceeding both our initial financial projections and in-place acquisition figures. This cash flow results in a strong 26.4% cash-on-cash return, generating substantial income each year for investors. Based on a 6.50% exit cap rate, the property’s value at stabilization is $950,000, totaling an equity value of $364,000 for investors which represents a 3.2x equity multiple or $251,249 in profit.

For a clearer perspective on performance and valuation, below is a detailed comparison of our initial financial projections at acquisition versus the fully stabilized actuals, highlighting both the dollar and percentage differences relative to in-place and projected values:

Despite the strong valuation and impressive return metrics, we’ve decided to hold onto the property. The robust cash-on-cash returns, combined with the continued growth and potential of the Northern Liberties neighborhood, offer significant upside. By holding the property, investors can continue to enjoy steady cash flow and benefit from future appreciation as the area evolves with ongoing developments and increased demand.

This decision aligns with our long-term investment philosophy at KWM Capital: focusing on assets that not only generate immediate returns but also offer sustained growth over time. The Northern Liberties Apartments exemplifies the success of a well-executed value-add strategy, with renovations, operational improvements, and market insights all coming together to create a high-performing, stabilized asset.

Letting go of this one would certainly be difficult—it’s a testament to the power of thoughtful planning and strategic execution in real estate investing. For now, we’re excited to watch this property continue to thrive as we apply the lessons learned here to future projects.

Lessons learned & Key takeaways

Reflecting on this journey, I am often reminded how far I’ve come—from countless hours spent absorbing real estate content during long drives, to immersing myself in Philly’s neighborhoods through “market research” in coffee shops and bars (haha), to cutting down a tree myself with a handsaw, or moving water-filled toilets, to transforming apartments. Every step, no matter how big or small, contributed to the foundation of KWM Capital and the establishment of a repeatable, proven strategy. Each moment taught me something invaluable, and together, they’ve shaped both my approach to investing and my vision for the future.

This deal hopefully helps validate the KWM Capital Way, proving that a well-executed value-add strategy can deliver exceptional returns for our investors. Achieving a 3x equity multiple in under five years, while also providing significant cash-on-cash returns, underscores the power of thoughtful investment, strategic upgrades, and proactive asset management. The success of this deal isn’t just a testament to hard work; it’s a confirmation that the principles we hold at KWM Capital work.

Looking ahead, we’re applying the lessons learned here to every deal we pursue. The ability to adapt when financing terms shift, the value of rigorous market analysis, and the importance of operational efficiencies all strengthen our investment thesis. At KWM Capital, our commitment remains the same: to uncover hidden value in properties, optimize performance, and create meaningful investment opportunities. This journey has reaffirmed our dedication to providing our investors with the same opportunities for growth and passive income that inspired the firm’s founding.