“The journey of a thousand miles begins with a single step.” — Lao Tzu

My journey in real estate investing wasn’t a straight path to overnight success; it was years in the making. While my early investments came with quick decision-making, I didn’t jump into my first multifamily purchase on a whim. That seemingly swift, 24-hour decision to purchase my first multifamily real estate investment was built on countless hours of work, educating myself with every real estate resource I could find. From listening to Bigger Pockets podcasts to old Rich Dad Poor Dad Real Estate Education CDs my dad kept in his car, I immersed myself in the fundamentals and strategies of real estate investing. During the summer before my senior year of college, on my commute to an internship in Malvern, PA, I turned my car into a personal classroom, consuming as much real estate content as possible. I’d daydream about my first investment and would practice underwriting deals on an Excel spreadsheet that, in hindsight, was embarrassingly basic.

Looking back at my prior investments, it may seem like they happened in the blink of an eye. In reality, my first multifamily property acquisition was five years in the making and wasn’t the result of luck. It was driven by strategic planning, hard work, and a willingness to learn at every step of the investment timeline. I’ve always pushed myself to keep learning and improving, striving for efficiency and excellence in every deal.

As I honed my skills, I often found myself in conversations with family, friends, and acquaintances who were eager to invest in real estate but felt overwhelmed by its complexities. Many were interested but lacked the time or passion to dive into the details of finding, managing, and improving properties. I saw an opportunity to bridge that gap—a way to help busy professionals benefit from real estate investing without getting bogged down in the day-to-day challenges and expertise needed.

This is why I started KWM Capital. My vision was simple yet impactful: to bring folks alongside me on this journey, sharing both the rewards and the insights that make real estate investing such a powerful tool for building wealth. In doing this, I want to demystify the process. My goal is to showcase exactly how KWM Capital can identify an underperforming asset, implement value-add strategies, and maximize returns for investors.

And that brings me to this case study. In this example, you’ll see how we approach a deal, from acquisition to renovation to stabilization. This case study will be presented in three parts, each diving into a different phase of the investment journey:

- Part 1: A comprehensive summary of the deal, including the project overview, performance highlights, investment timeline, and a glimpse of the transformation through before-and-after photos

- Part 2: An in-depth exploration of market selection, deal identification, the capital stack, initial financial projections, and the successful completion of the acquisition

- Part 3: A detailed breakdown of renovations and value-added, asset stabilization, analysis of financial performance, lessons learned, and key takeaways for future investments

I’m excited to pull back the curtain and give you a look at the KWM Capital Way. If you’d like to learn more about how you can partner with KWM Capital or explore similar investment opportunities, schedule a call with me here. Know someone who might be interested? Feel free to forward this case study to them or have them subscribe to our newsletter.

Let’s get into it!

Northern Liberties Apartments: Investment summary and timeline

Northern Liberties Apartments, a 3-unit apartment community located in Philadelphia’s vibrant Northern Liberties neighborhood, represented an exceptional investment opportunity for my first multifamily deal. This area, known for its cultural vibrancy and recent revitalization, has become a magnet for young professionals, artists, and entrepreneurs over the last 10 years. With its eclectic mix of restaurants, galleries, and green spaces, Northern Liberties has experienced rapid growth, which is exactly what I was looking for in my first deal.

The property itself had great bones and clear potential for improvement. The first-floor unit consisted of a 1-bedroom, 1-bath layout with an office and a spacious outdoor patio, while the second-floor unit featured a 1-bedroom, 1.5-bath configuration with a large outdoor deck. Both units were significantly under market rent, presenting immediate upside potential through effective asset management. The third floor, a 2-bedroom, 1-bath unit with exposed brick and city views, was delivered vacant, providing the perfect opportunity for house-hacking. Recognizing the property’s untapped potential, KWM Capital set out to reposition this triplex into a high-performing asset.

Project overview and performance highlights

- Property type: 3-unit multifamily apartment community

- Strategy: Value-add

- Acquisition date: May 2019

- Purchase price: $670,000 at a going-in cap rate of 6.50%

- Acquisition financing: 87% LTV, secured through a combination of a first-position mortgage at 4.38% interest (30-year amortization) and $83,500 bridge loan

- Total equity investment: $112,751 (60% KWM Capital, 40% LPs)

- Renovation cost: ~$41,000 (funded by bridge debt and cash flow)

- Key upgrades: Implementation of in-house property management, operational efficiencies, full unit renovations, and second-floor unit Airbnb conversion

- Refinance: December 2021, refinanced at 75% LTV with a 3.88% interest rate (30-year amortization), reflecting a $750,000 property valuation. Refi repaid bridge debt, a portion of which had funded renovations

- Annual rent roll at acquisition: $52,320

- Annual rent roll at stabilization: $77,400 (+48% from acquisition)

- Net operating income (NOI) increase: +41% from acquisition

- Cash-on-cash return (CoC) at stabilization: 26%

- Property value at stabilization: $950,000 (assuming exit cap rate of 6.50%)

- Projected return: 1.8x equity multiple or $204,604 ($91,854 profit)

- Actual return: 3.2x equity multiple or $364,000 ($251,249 profit)

How we found it

There are numerous government programs and incentives designed to encourage affordable housing investments. These can include tax credits, grants, and low-interest loans, which can significantly reduce the financial burden on investors. By leveraging these incentives, KWM Capital maximizes the profitability of our projects while supporting government efforts to address housing shortages.

Why we liked it (investment highlights)

Northern Liberties Apartments was a homerun investment opportunity for several compelling reasons:

- Prime location: Situated in one of Philadelphia’s fastest-growing neighborhoods, the property offered proximity to the area’s thriving social and cultural scene (2nd Street Northern Liberties), public transit, major highways (I-95), and downtown Philadelphia. Northern Liberties’ growth trajectory, combined with new development, ensured strong housing demand and rising rental rates

- Well-maintained: The previous owner kept the building in good condition, with little deferred maintenance needed. This would allow us to focus renovation efforts on targeted, high-value improvements to maximize rents

- Strong fundamentals: The property was purchased at a below-market price, offering built-in equity at acquisition. Additionally, it generated positive cash flow from day one, providing financial stability and flexibility during renovation periods when units were temporarily offline

- Immediate upside: All three units were significantly below market rents, with the third floor delivered vacant, presenting a clear opportunity to boost cash flow and drive forced value appreciation through strategic rent adjustments and occupancy optimization

- Favorable target returns: Through a carefully executed value-add strategy, we projected a significant increase in rents, driving both cash flow and property value growth. Utilizing conservative underwriting, we initially targeted a 19% cash-on-cash return upon full stabilization, with an anticipated equity multiple of 2.0x by the end of 2022—effectively doubling the initial investment over the hold period

Business plan

The business plan for Northern Liberties Apartments was straightforward:

- Targeted renovations: We focused on high-impact unit interior upgrades to enhance tenant appeal while maintaining cost efficiency. These included updating appliances, fixtures, and finishes, as well as making strategic improvements to common areas and outdoor spaces

- In-house property management: Implementing in-house property management (Chameleon Property Management) allowed for hands-on oversight of asset management

- Operational efficiencies: Leveraging property management software streamlined processes such as rent collection, lease management, and maintenance requests. These efficiencies helped minimize operational costs and reduce vacancy rates

- Rent stabilization: Bringing all units to market-rate rents was a key priority, achieved through targeted upgrades and improved tenant experiences

- Cost segregation and tax efficiency: Conduct a cost segregation study to capture bonus depreciation, maximizing after-tax returns for investors

How we funded it

Financing for the property required creativity to close the deal within 45 days:

- Debt: Secured a first-position mortgage at 75% Loan-to-Value (LTV) with a 4.38% interest rate and 30-year amortization. To address last-minute changes in lender terms, KWM Capital obtained an $83,500 bridge loan, ensuring sufficient funds for closing and renovations. This brought the total financing to 87% LTV

- Equity: The remaining 13% of the capital stack, totaling $112,751, was funded through a combination of 60% investment from KWM Capital and 40% from LP contributions

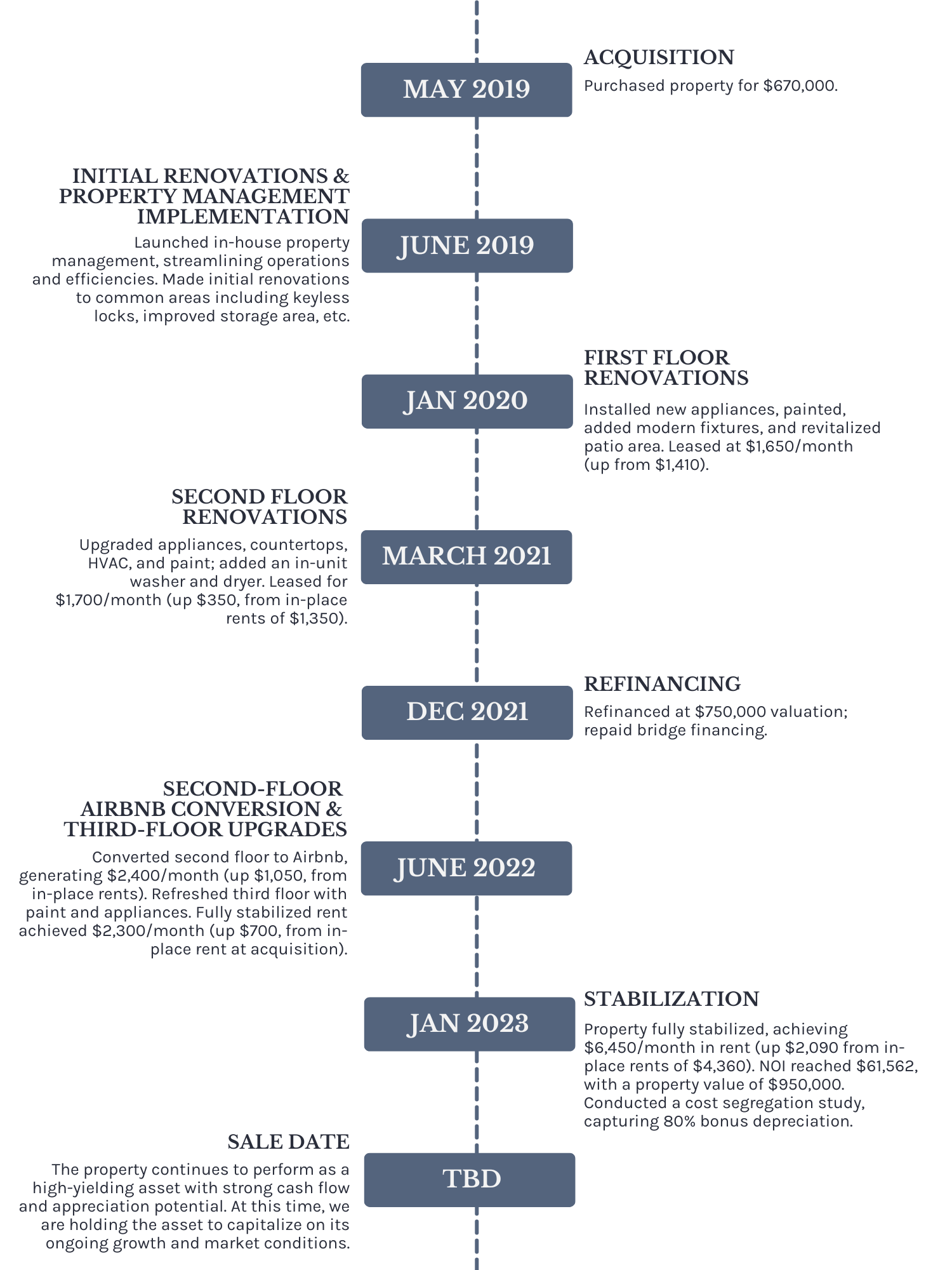

Investment timeline

Every real estate investment has its own unique journey. From acquisition to stabilization, we took strategic steps to maximize the property’s value. Below you’ll find a timeline of key milestones that highlight the transformation and path to achieve stabilization.

Before and after photos

Up next

Thank you for taking the time to read through Part 1 of this case study. I hope this breakdown of the project overview, performance highlights, and investment timeline has provided valuable insights into the KWM Capital Way.

Your interest and support mean a lot, and I’m excited to continue sharing the story of this deal with you.

- Part 2: We’ll dive into the market selection process, deal identification, and how we structured the capital stack. Learn about the creative financing solutions we implemented to ensure this deal’s success, as well as our initial projections and how they guided our acquisition strategy.

- Part 3: A deep dive into the renovation journey, from design decisions to operational improvements, and how these upgrades translated into significant financial performance. We’ll wrap up with lessons learned and the key takeaways that continue to shape KWM Capital’s strategy.

If you’d like to discuss how you can achieve similar results or learn about future investment opportunities with KWM Capital, schedule a call with me here.

Please share this with anyone who might be interested in multifamily real estate investing and encourage them to subscribe to my newsletter for updates and insights!